How much did I pay my vendors and receive from customers?

- Posted on Feb 27, 2018

There is a helpful report in QuickBooks that we get asked quite a bit how to do, how much did I pay my vendors and how much did I receive from customers? We had a client recently inquire over a report he needed on how much he has paid all his vendors for the year. He also wanted to to know what his monthly expenses were to each vendor. QuickBooks Desktop or QuickBooks Online can produce this report and also for customers.

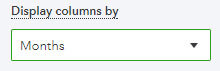

In QBO, search for the report in the top right search bar, Expenses by Vendor Summary. If the search bar acts finicky and cant find it, it happens. :/ Go to reports > All reports > Review Expenses and Purchases > Expenses by Vendor Summary.  Set the date for the period needed, last year for instance, click run report. These are the summary totals for the period you selected. If you want to total by month. Change the pull down menu, display columns by that is currently showing total only, to months. Click the run report button to refresh with these settings.

Set the date for the period needed, last year for instance, click run report. These are the summary totals for the period you selected. If you want to total by month. Change the pull down menu, display columns by that is currently showing total only, to months. Click the run report button to refresh with these settings.

In QBD, go to reports, company & financial, Expenses by Vendor Summary. Set the date for the period needed, last year for instance, click run report. These are the summary totals for the period you selected. ![]() If you want to total by month. In the top portion of the report window, change the setting for show columns, from total only to month.

If you want to total by month. In the top portion of the report window, change the setting for show columns, from total only to month.

To run these reports for the customer side, follow the exact instructions, just replace the word Vendor with Customer (or Client depending on how you have that set up in QBO). In QBO the report is under Review sales. Hope this is helpful for you.

This report does not show how much was PAID to a vendor. It only shows the “expenses” entered.. as in, it shows bills, not bill payments/checks. As there are frequently unpaid bills at any given time, the Expenses usually don’t match the actual payments. This will only work if all your bills and payments were all entered and paid in the reporting period you selected (which usually doesn’t happen).

Payments made to a vendor might also have paid bills that were entered in a prior reporting period. Picture how a 2019 report would display with a December 2018 bill paid January 2019.. although the vendor was paid in 2019, the 2019 Expense report would not show it. And the 2018 Expense report would show a bill that wasn’t actually paid in 2018).

As of today, 12/31/19, there is no way to pull a report showing how much was paid to a vendor. Even the 1099 reports don’t work like you need them to. The best you can do is a customized Transaction List by Vendor or Bills and Bill Payments, but those will not display a Total or Balance. You have to add the amounts manually or export to Excel and create a Sum function. It’s simply better (for a thousand reasons) to get Desktop, where this report – and many other functions unavailable on Online – come standard.

Hi Anna, have you tried flipping the report to cash versus accrual? That will display checks and bills that were paid.