Exclude banking transactions in QBO – QuickBooks Online

- Posted on Oct 16, 2018

Have you ever needed to exclude banking transactions in QBO? It’s there for a reason and if you use the online banking function in QuickBooks Online, you need to know what it is for. I had a client once that didn’t get it, even after several explanations. Her not getting it was the result of losing her as a client, no joke. She blamed me for deleting transactions. This was many years ago, I assume by now she has figured it out I was just doing my job here is why.

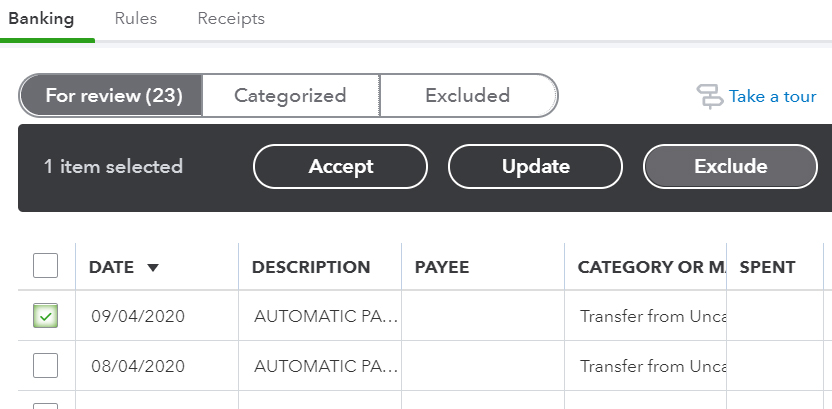

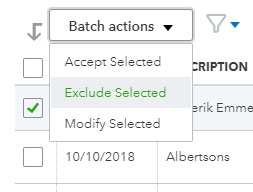

Old Version of QBO

Downloading transactions from the bank isn’t a seamless process, hiccups can occur. You have two options, enter the transaction or exclude the transaction. If a duplicate downloads, don’t enter it, exclude it. If you enter it you will have to delete it when you reconcile. It will then magically appear again in the online banking creating a continuous loop if you are not watching dates and paying attention to what you are entering. If this happens to you, delete the transaction, immediately go to the online banking and exclude it from appearing again. ✔

Another reason why you would exclude banking transactions in QBO

Your payroll transaction may download from the bank in one lump sum for all of payroll, while what you have entered are checks and tax payments. When this happens, use the find match function and check off all your payroll related items until you have completely matched and balanced to zero. This links all the transactions to the one entry from the bank, and it also confirms that you have entered all correctly. Doing so will make your reconciliation go much easier. Same goes for multiple receive payments that may be entered to the bank account separately but deposited together at the bank.